Debt can play a powerful role in the maintenance of homelessness: non-payment of rent is one of the most common reasons for eviction, and the resultant rental debt accrued can be used as the basis for exclusion from subsequent housing.

The evidence shows that people of color in the U.S. are disproportionately likely to be extremely low-income renters (i.e., at or below the poverty line or 30% of area median income), putting them at greater risk of suffering from rental debt. Findings also demonstrate that the majority of renters behind on rent in the U.S. are people of color (65%) and low-income (80%).

In this learning brief, Community Solutions explores the existing evidence on persistent disparities in rental debt and how homeless response leaders might tackle or consider rental debt in their strategies to prevent or reduce homelessness.

THE EVIDENCE

People of color in the U.S. are disproportionately likely to be extremely low-income renters. Renters who fall into the low-income bracket are living at or below the poverty line or 30% of area median income, which puts them at greater risk of suffering from rental debt. According to a 2022 report by the National Low Income Housing Coalition, 20% of Black households, 18% of Native American or Alaskan Native households, 15% of Latinx households, and 6% of white non-Latinx households are extremely low-income renters.

Evidence demonstrates that these uneven risk levels translate into persistent disparities in debt and payments. At the start of 2021, 53% of Black renters reported having unpaid bills and rent debt, a proportion greater than that of Asian renters (27%), Latinx renters (38%), and white renters (21%).

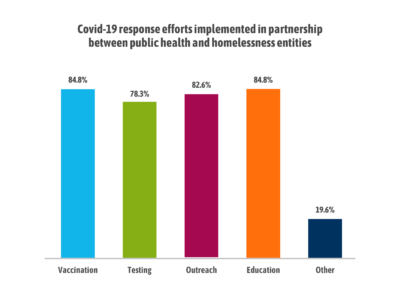

Another study conducted in Pennsylvania highlighted the differential burden of the Covid-19 pandemic: low-income, Black, and Latinx (compared to higher-income and white) renters were more likely to be rent-burdened and experience utility insecurity. Communities with larger populations of color had much higher rates of utility arrears and disconnections, as well as enrollments in utility assistance programs.

One valuable source of evidence and resource for a community is the Rent Debt Dashboard developed by the National Equity Atlas and Right to the City Alliance. It showcases persistent disparities in rent debt with up-to-date data (refreshed every 2 weeks) at the national, state, and 15 metro area levels. The debt map provides estimates of local rent debt across all states and counties, as well as 562 cities. It includes the average rent debt per household, which may help a community identify whether resolving rent debt is a useful strategy for reducing inflow into homelessness.

The National Equity Atlas conducted an analysisof rent debt data in mid-August 2021 and found that on a national level, nearly two-thirds of renters with arrears were people of color. Renters of color were thus more likely to owe back rent and more vulnerable to eviction risk than white renters. At this point in time:

- 27% of Black renters were behind on rent

- 19% of Latinx renters were behind

- 18% of Asian or Pacific Islander renters were behind

- 17% of multiracial renters were behind, and

- 9% of white renters were behind

The average amount of rent debt per household was $2,550, and the typical renter in debt was 3 months behind. However, 25% of low-income renters (i.e., annual income < $50,000) were 4-7 months behind on rent, compared to 13% of renters making over $50,000, and the lowest-income renters owe the most back rent.

Neighborhood-level analyses consistently find concentrated rates of eviction in predominantly Blackand Latinx neighborhoods, suggesting that rent debt may also be a contributing factor driving homelessness in these communities.

Important Considerations

Though the reviewed evidence highlights persistent disparities in rental debt and utility arrears, it is worth noting that persistent disparities in debt burdens are systematic: people of color in the U.S. experience higher rates and amounts of medical debt, criminal legal debt, and student loan debt compared to white people. Compounded by an income gap, persistent disparities in debt hinder upwards mobility for people of color and fuel economic inequality.

Due to a lack of findings on the types and amounts of debt among people experiencing homelessness, the evidence above focuses on renters. However, studies have linked specific types of debt to longer durations of homelessness. In a study with 101 adults experiencing homelessness in the greater Seattle area, over 38% of respondents reported being in legal debt, owing an average of over $12,000. Moreover, after controlling for other variables, those with legal debt experienced nearly two years of additional homelessness. A separate study of 60 individuals experiencing homelessness in Seattle found that two-thirds of respondents reported current medical debt, and those experiencing trouble paying off debt were likely to experience over two years of additional homelessness.

Recommendations

The evidence shows that people of color and/or low-income people disproportionately suffer from rental and utilities debt. As such, giving individuals in, or at risk of, homelessness the funds to pay this debt can be an approach to reduce barriers to long-term housing.

Understand the distribution of debt burden in your community. Communities can tackle rental debt as a fair access and anti-poverty strategy. Communities can make use of the rent debt map, and other sources such as Census data, to identify the rate and amount of rental debt at the county level paired with racial and ethnic distributions. The payment of rental arrears both helps everyone and, if done by taking into account persistent disparities and poverty, brings communities closer to fairness in their homelessness response systems.

Use that knowledge and information to ensure assistance limits are not reinforcing unequal debt burdens. Communities can use flexible funding to pay off debt and help stabilize individuals and open opportunities for future housing. When utilizing flexible funding to help individuals pay off rental arrears, communities should evaluate if they can avoid assistance ceilings when possible. Using a theoretical but realistic example, a community may historically cap debt repayment assistance at $2,000; this cap may create unintentional preference for white individuals who are less likely to have higher amounts of debt as compared to certain other people of color, especially Black and Latinx individuals, who may need more than that $2,000. By having no cap, a community can correct for the high likelihood that rental debt in their community varies by race and/or ethnicity due to structural barriers. A funding source communities might look into for rental and utility arrears is the federal Emergency Rental Assistance program; the National Low Income Housing Coalition created a comprehensive FAQ that confirms these funds are available for people experiencing homelessness, regardless of immigration status.

Works Cited & Other Resources

Reports

The Racial Health and Wealth Gap: Impact of Medical Debt on Black Families. Authored by Berneta L. Haynes with the National Consumer Law Center, March 2022.

Black-white disparity in student loan debt more than triples after graduation. Authored by Judith Scott-Clayton, and Jing Li with the Brookings Institution, October 2016.

State of Working America Wages 2019. Authored by Elise Gould with the Economic Policy Institute, February 2020. Findings specific to Black-white wage gaps described in Gould’s blog post.

Rent Debt in America: Stabilizing Renters Is Key to Equitable Recovery. Authored by Sarah Treuhaft, Michelle Huang, Alex Ramiller, Justin Scoggins, Abbie Langston, and Selena Tan with the National Equity Atlas, September 2021.

The coming eviction crisis will hit Black communities the hardest. Authored by Carl Romer, Andre M. Perry, and Kristen Broady Monday with the Brookings Institution, August 2021.

The Gap: A Shortage of Affordable Rental Homes. Authored by Andrew Aurand, Dan Emmanuel, Matthew Clarke, Ikra Rafi, and Diane Yentel with the National Low Income Housing Coalition, April 2022.

Understanding Racial and Ethnic Disparities in Health Outcomes and Utility Insecurity Resulting from Covid-19. Authored by Dan Treglia, Mina Addo, Meagan Cusack, and Dennis Culhane, 2021.

Research Articles

Criminal justice debt during the prisoner reintegration process: Who has it and how much? Authored by Nathan Link in Criminal Justice and Behavior, January 2019.

Presence of Any Medical Debt Associated With Two Additional Years of Homelessness in a Seattle Sample. Authored by Jessica Bielenberg, Marvin Futrell, Bert Stover, and Amy Hagopian. The Journal of Health Care Organization, Provision, and Financing, January 2020.

Court-imposed fines as a feature of the homelessness-incarceration nexus: a cross-sectional study of the relationship between legal debt and duration of homelessness in Seattle, Washington, USA. Authored by Jessica Mogk, Valerie Shmigol, Marvin Futrell, Bert Stover, and Amy Hagopian. Journal of Public Health, June 2020.

Forced Out: Race, Market, and Neighborhood Dynamics of Evictions. Dissertation by Tim Thomas, 2017.

The Neighborhood Context of Eviction in Southern California. Authored by Michael C. Lens, Kyle Nelson, Ashley Gromis, and Yiwen Kuai. City & Community, December 2020.

Online Articles & Blog Posts

Rent Debt & Racial Inequality in 2021. Authored by Rob Warnock with Apartment List, January 2021.

Questions & Answers about Eviction by The Eviction Lab.

Dashboards, Maps, and Data

Rent Debt Dashboard developed by the National Equity Atlas and Right to the City Alliance, last updated May 2022.

Debt in America: An Interactive Map developed by the Urban Institute, last updated June 23, 2022.

- Shows overall and medical debt in collections (i.e., past-due credit lines that have been closed and charged-off on the creditor’s books and unpaid bills reported to the credit bureaus that the creditor is attempting to collect), as well as the share of student loan holders with student loan debt in default and auto/retail delinquency rates

Racial and Ethnic Diversity in the United States: 2010 Census and 2020 Census. August 2021.